Disney Visa Credit Cards: Are They Worth Getting?

As Disney vacationers, we’re all too familiar with the ‘I wonder if it’s worth it to…’ inner monologue that happens with almost every decision. It’s a question that comes up pretty often when you’re budgeting your time, money, or even limited FastPasses. So this week, I thought we could take a look at Disney credit cards. What are the benefits, what’s the trade off, and are they worth getting?

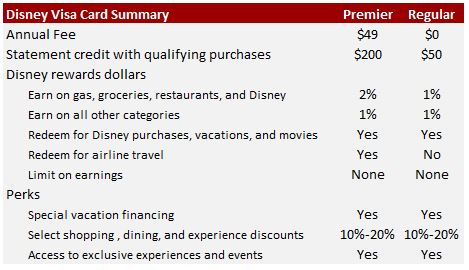

Disney offers two credit cards, their regular Disney Visa Card and then a Disney Premier Visa Card. Let’s get started with the basics of the two cards.

The Cost: Don’t worry, I’ll get into all the fun perks and benefits of having the cards, but I want to lay out the costs first. The basic Disney Visa Card has no annual fee. The Premier currently charges a $49 annual fee. If you’re not too experienced with credit cards and rewards, it’d be easy to say that the free one is the better option because it automatically costs $50 less per year over the other card. However, the Premier card also comes with better benefits, so it’s not as black and white as it may seem at first. We’ll walk through some scenarios later to help you weigh your options here.

The Perks: Now that we’ve got the responsible adult stuff out of the way for the moment, let’s talk about all the exciting benefits of having the cards.

- Free Money: Okay, maybe it’s not entirely free because you have to jump through a few hoops, but who doesn’t love a little extra cash? As a new card member, you can earn a statement credit after qualifying purchases. Wondering how much you’ll see in rewards and what counts as a qualifying purchase? Well, that depends on which card you have. The Disney Visa offers $50 back after your first purchase. They have some restrictions as far as what qualifies (e.g. balance transfers and cash advances don’t count), but otherwise it’s fairly easy to meet this requirement. Buy your next coffee with this card, and you’re all set. The Premier card is good for a $200 credit, but you have to spend $500 on purchases in the first three months.

- More Free Money: You earn Disney Rewards Dollars when you use your card for purchases. For most purchases, both cards earn 1%. The Premier card offers 2% on purchases at gas stations, grocery stores, restaurants, and most Disney purchases. Unfortunately, you can’t use rewards dollars on just anything though. They can only be redeemed for Disney-related expenses. These include Disney theme park tickets, Disney resort stays, Disney Cruise Line packages and onboard activities, Disney movies (but only at select theaters), Disney Store or shopDisney.com purchases, etc. If you have the Premier version, you can redeem Rewards Dollars for airline travel as well, without any restrictions on the airline or destination.

- Savings: Both cards offer 10% off some merchandise purchases over $50. They also offer 10% off at select restaurants, but those are subject to blockout dates and additional exclusions apply (e.g., alcoholic beverages are excluded). Select tours, recreation, spa experiences, and Disney Cruise Line photo and Castaway Cay packages can be discounted between 10-20% for cardmembers. And lastly, both cards offer special vacation financing on select packages.

- Unique Experiences: Both cards will get you access to exclusive experiences. Disney World and Disneyland offer character meet and greets for cardholders only. If you have a Disney Store near you, you may also be able to attend card member events at the store. You can even use the card for an exclusive VIP package for Disney on Broadway or buy a cardmember collectible pin.

- Disney Designs: Want to have a card in your wallet with Cinderella Castle on it? Or maybe you’re feeling the Dark Side and want to throw in your support for Darth Vader. Disney offers these designs and a handful of others as well for their cards. You can be reminded of your favorite vacation destination every time you open your wallet. And for those that want to keep their love of Disney on the down low, they offer a plain old boring one that looks like any other card.

Tradeoffs: After all that talk of free money and exclusive benefits, you might be thinking, Where do I sign up?! And that’s when I typically tell people to hold on. All those perks sound great, until you compare them to what you could be giving up from a different, non-Disney, rewards card. For example, I have a card that gives me 6% back at grocery stores. And I can use that money that I get back as a statement credit for anything. Hypothetically, I can go to the grocery store, buy Disney gift cards for my vacation, earn 6% back on that purchase, and then use that 6% back as a statement credit when I pay off other expenses from my vacation. Not only would I get more money back, but I wouldn’t be restricted in how I could use the cash back. If I want to use those rewards dollars to pay off part of my statement from a month without Disney expenses, I can do that. And now, because my bill was lower, I have extra cash I can spend on Disney if I want.

As another example, a card that offers a flat 2% back on every purchase would beat the cash back from even the Premier Card by default.

Final Considerations: And now you might be thinking, well, I guess I don’t really need a Disney card after all. But wait, there’s more! The scenario above doesn’t negate ALL the card benefits. For example, with a different card, you’ll miss out on the discounts and special experiences that you get with the Disney Visa cards. That’s why you need to think about how important those are to you and whether there is another way to get what you want. As an Annual Passholder, I already get a discount on select merchandise and dining locations. Do I really need the card for exclusive meet and greets? Probably not. However, if you’re an Annual Passholder or DVC member who forgets to show your card for discounts, then maybe paying with the Visa will remind you or the Cast Member to apply the discount.

Occasionally, Disney cards offer substantially higher rewards points for certain categories of purchases, in which case, the benefit of the card becomes significantly better. There’s also just that general excitement that comes from having the card in your wallet and having those rewards dollars already set aside for Disney related expenses. Some people appreciate that psychological boost.

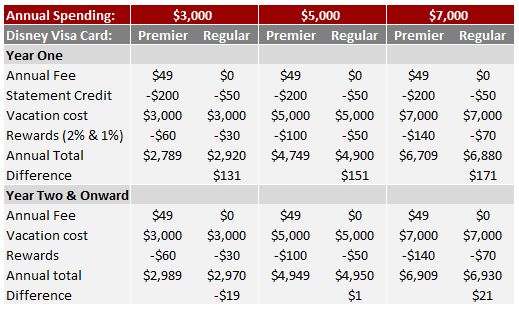

Examples: We’ve talked about the basics of the cards, so now it’s time to show how it all plays out. Remember, the main differences between the two are the annual fee, initial one-time statement credit, and an additional 1% back on some purchases. For some examples, let’s assume we have three families that only use their card for their Disney vacation expenses. They usually spend around $3,000, $5,000, and $7,000 annually. Here’s what that looks like in the first year and then each subsequent year.

From this, you can see that $5,000 (technically $4,900) is the breakeven point in our simplified example. Essentially, the additional percent reward of the Premier card on $5,000 in purchases returns enough to offset the nearly $50 annual fee. If you spend more than that each year, you are better off having the Premier card over the regular one. For spending under $5,000, you win initially with the Premier thanks to the statement credit, but each year after that you’re losing by a bit.

In the end, the decision about whether either card is worth it depends on what else you have available to you. For the most part, you’re better off with other cards. It’s easy to find cards that offer better rewards and greater flexibility. If you’re okay with the effect another card will have on your credit, then the basic Disney Visa Card can still be a good option. And if you spend a lot of money on Disney every year, then even the Premier Disney Visa is better than just paying cash assuming you pay your statement in full every month to avoid any interest fees.

What are your thoughts on the Disney Visa Credit Cards? Have you signed up for either one? Do you use them often? Let us know in the comments below!

I have a Costco Visa as my primary rewards card and use the Disney card when I go to grocery stores where the deal is better and when I get gas at places like Kroger and Walmart. I also charge absolutely everything I can and pay off monthly. The way I maximize my rewards I use the rewards to pay for the trip. It works well with other cards.

If you are going to get one for the perks, get the free one and don’t spend anything on it. There are MUCH better cards in the market now for earning- like the Chase Sapphire series. And those points are a lot more flexible than the Disney points are.

I love that you do break even analysis. Thanks for the data!

Of course, Amy! I couldn’t help myself 🙂 Thanks for reading!

I got the Premier card for the sign-up bonus. Since then, I’ve kept it for trips to WDW. Each year, I get the renewal notice and call up Chase asking to close the account and transfer to the free card. They then offer to refund the annual fee. This makes it worth it to keep the Premier card.

Oh, wow, that’s great! I wonder how long they’ll keep offering that? Definitely seems worth it to me for the time being though. Thanks for sharing!

I got the basic card a few years ago and got $150 by making minimum purchases within 3 months. That was definitely worth it. I have also used the card to get some of the discounts and free photo at Disney World. While I tend to use my main credit card, I have occasionally used the Disney card. And it’s nice having a card with Mickey & the gang on it.

$150 is definitely better than the current offer. Sounds like you got in at the right time! Thanks for commenting!

Nope. Our Costco Citi Visa makes way more sense. 4% rebate on gas, 3% on restaurant and travel expenses (airfare, resort, tickets), 2% at Costco, 1% on everything else. No annual fee and excellent travel insurance, accidental loss/theft/damage purchase protection, extended warranty coverage, price rewind (refunds the difference if the price later drops on a purchased item).

I absolutely love Costco, and that card sounds like a pretty great deal. Maybe that will be my next is it worth it analysis at home!

The card (both I guess) offers 6 months free financing on your vacation costs – room, tickets, dining plan.

Getting the Disney Visa Rewards card (the free version) has proved to be an awesome choice…though much of that is due to my awesome family. When I signed up for the card (around June 2017), I got a $50 statement credit. I then got an additional $150 in reward dollars from referring three family members. They each spent at least $500 in the first three months which, through the referral deal, led to them each being sent a $200 Disney gift card (which they gave to me. Did I mention how awesome they are?!?!). They continued to use the cards (not exclusively because they have other rewards programs they understandably like to use for themselves) through the year and recently ordered their redemption cards for my trip in May. Between the bonuses, the rewards they each earned, and the rewards I’ve earned, I’ve gotten over $1,000 extra to fund my vacation. This is a huge game changer for me.

I’ll also be taking advantage of some of the discounts on dining (lunch at Le Cellier and dinner at Kona Cafe) and merchandise on my trip. I probably won’t do the character meet but I also don’t travel with kids.

So, obviously, my generous family going above and beyond is part of why this worked out so well for me, but I’m definitely glad I got the card. I use it basically as I would a debit card, paying off the balance every month, so the rewards I earn really are like free money. Depending on your income and lifestyle, I could see other cards (like travel rewards or cash back) working better as the card you put primary expenses on, but it really works great for me.

Wow, I can see why the card worked out so well for you with family like that! That’s fantastic, thanks for sharing!

I use my Disney Visa (premier version) for everything, all of my bills and extra spending. I pay it off in full every month. We go to Disney every other year and usually have about $1200 of Disney Reward Dollars each trip we go on. We just get it on the redemption card and use it to buy our food and souvenirs while we are there. I realize I could get more cash back from a different card but I like having my rewards be Disney money only. I would probably end up spending cash back rewards on other less fun things! So my Disney Visa is basically a vacation savings plan!

this is exactly what I do!

So you’d rather pay $75 or $100 for a $50 Disney gift card? Other cards pay 1.5% or 2% (or more in some cases) which means that you are passing up larger rebates just to get it in Disney form.

My experience is that the Disney Rewards Visa with no annual fee IS worth having in your wallet at Disney World. However, once you have the $50 credit earned, it’s not really worth using outside of the World.

Here’s what I did: Got the Disney Card, and used it enough to get the gift cards. Pulled the card out of my wallet and never touched it again until we were packing for Disney.

We used it at gift shops and restaurants that offered us an extra 10% off. (WORTH IT) I also used it for a couple of character meets (WORTH IT).

That was it. Everything else went on our other cards that paid better rewards. And the card has stayed in my dresser ever since. We’ll pull it out again just before our next Disney trip, though. Probably won’t use it, except for those exceptions. It’s still worth having for those. But you can do better for paying for groceries and gas.